Has gold reached its peak, and can silver still hold its ground?

Release Time:

2025-05-28

Interpretation of the reasons for the peak of gold and silver.

The old saying goes: Antiques in prosperous times, gold in troubled times! Few people pay attention to the value of antiques converted to gold, but gold remains the focus of everyone's attention. As of today's close, gold futures have fallen below 740, I wonder what it feels like for those who got on board at a high price to be swaying in the cold wind above 800 meters...

Previously, silver, also a precious metal, although not as popular as gold, also saw a considerable increase. However, silver's ability to act as a safe haven (industrial attributes as high as 58%) is not as good as gold's. After gold's rise, silver did not follow, but instead consolidated at a high level. Now that gold has peaked and is falling, silver has also broken through, and the fleeting dream of gold and silver in troubled times has come to an end...

As hard currencies, gold and silver, especially gold, why did they reverse course despite the strong optimism of several foreign investment banks such as Goldman Sachs? I believe there are several reasons:

1. Cooling of risk aversion.

Progress in Sino-US trade negotiations: High-level talks between China and the US have sent positive signals, easing market concerns about global trade friction, and capital is flowing from safe-haven assets such as gold to risk assets.

Easing geopolitical risks: The Russia-Ukraine conflict and the situation in the Middle East (such as the conflict between Israel and the Houthi rebels in Yemen) have cooled down in the short term, weakening the safe-haven demand for gold.

2. Changes in Federal Reserve policy expectations.

Delayed rate cut expectations: Federal Reserve Chairman Powell has recently been cautious in his statements, not explicitly signaling a rate cut, reducing market bets on a September rate cut, strengthening the US dollar index, and suppressing gold prices.

Rising US Treasury yields: As market expectations for the Federal Reserve to maintain high interest rates strengthen, US Treasury yields have risen, increasing the opportunity cost of holding gold (a non-interest-bearing asset).

3. Strengthening US dollar.

The US dollar index has recently rebounded (such as a 0.6% increase on May 8), making gold, priced in US dollars, more expensive for international investors and suppressing buying.

4. Technical correction and profit-taking.

After gold hit a record high of $3509.9 per ounce on April 22, some investors chose to take profits, leading to short-term selling pressure.

- Exchanges increase margin requirements (such as the adjustment of gold futures fees by the Shanghai Futures Exchange), suppressing speculative trading.

Why did silver only follow the rise when gold prices rose sharply before?

I believe this is also a question many uninformed retail investors want to ask, and I will interpret it here:

1. First of all, as a safe-haven tool, gold is clearly more favored than silver.

Gold, as a traditional safe-haven asset, is more likely to attract capital inflows during global geopolitical turmoil (such as the Russia-Ukraine conflict, the situation in the Middle East), and economic uncertainty (such as fluctuations in Federal Reserve policy, the US debt crisis).

Silver, **although it also has safe-haven attributes, has a higher proportion of industrial demand (about 58%), so when the market is worried about industrial demand (such as tariff policies affecting manufacturing), the safe-haven appeal of silver will weaken.

2. Secondly, the wave of gold purchases by central banks has pushed up gold prices, while silver has no such support.

Global central banks continue to increase their holdings of gold (such as more than 1,000 tons of gold purchases per year from 2022 to 2024), pushing up gold prices.

However, silver has not been massively reserved by central banks and lacks similar official demand support, so it has not been able to rise in tandem with gold.

3. Weak industrial demand restricts silver prices.

Gold has less industrial use (only about 10%), and its price is mainly driven by investment and reserve demand.

Silver's industrial demand (photovoltaics, electronics, automobiles, etc.) is affected by the global economic slowdown and the contraction of the manufacturing PMI, leading the market to be cautious about future demand growth.

Despite the long-term growth of the photovoltaic industry, short-term "desilvering" technologies (such as reducing the amount of silver paste used in photovoltaic cells) have also suppressed silver demand.

4. The gold-silver ratio (Gold/Silver Ratio) is at a historical high.

The current gold-silver ratio has exceeded 105, far higher than the historical average (50-80), indicating that silver is severely undervalued relative to gold.

Theoretically, a high gold-silver ratio may trigger a rebound in silver, but the market recently prefers gold, resulting in silver failing to keep up.

5. Market liquidity and the flow of speculative funds.

The gold market has stronger liquidity, and institutional investors (such as ETFs, hedge funds) are more inclined to allocate gold, pushing up its price.

The silver market is smaller and more affected by quantitative trading, with sharp short-term fluctuations, but lacks sustained capital inflows.

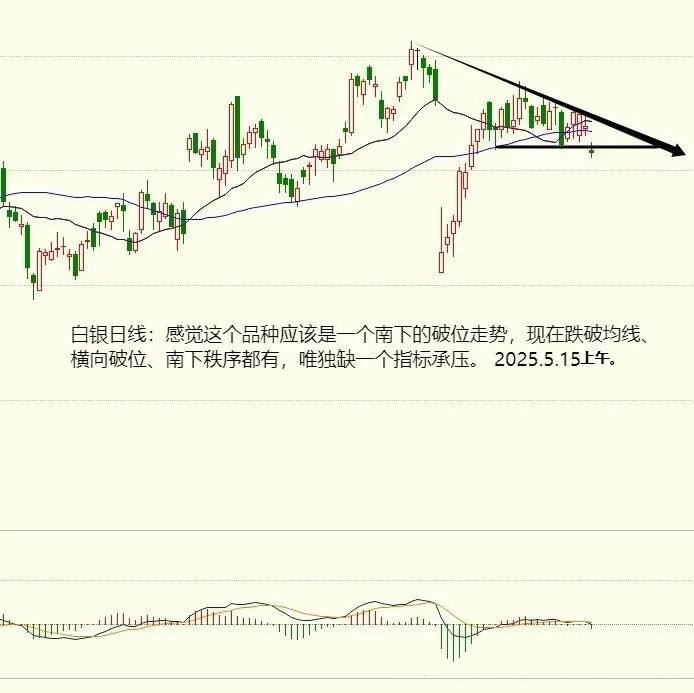

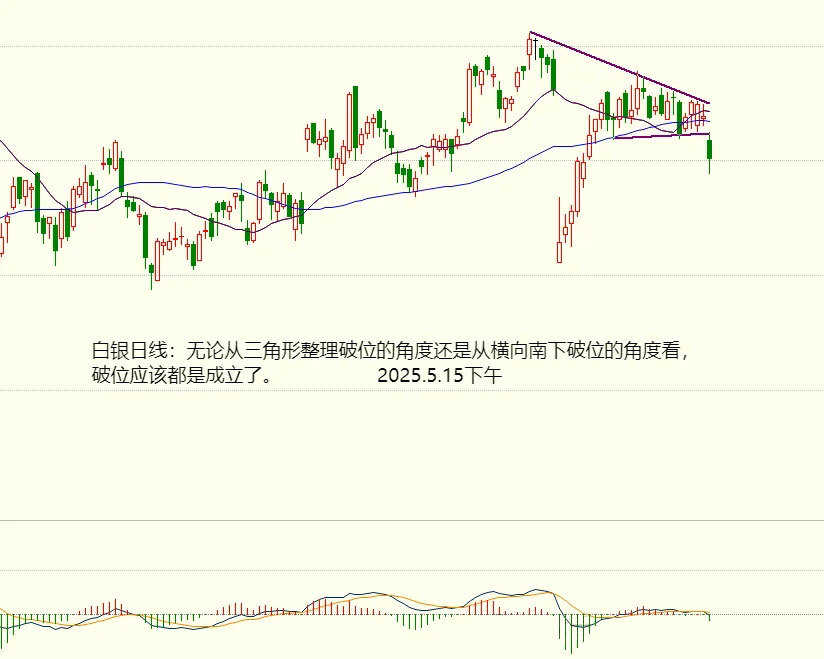

Technical analysis of market trends.

Market summary: On the night of May 14, affected by the sharp drop in US silver in the overseas market, domestic silver opened lower with a gap, and the market showed a technical breakdown. The price opened lower and moved lower throughout the day, eventually closing with a medium-sized negative candle.

Our conclusion: When gold rose sharply before, silver was dragged down by its industrial attributes, and the increase was less than expected. Currently, it is affected by the easing of Sino-US trade friction and the recovery of the domestic industry, and the decline is also smaller than that of gold. As for the future trend, I personally tend to continue to go south, because from the perspective of technical analysis, a breakdown is a breakdown, and currently, the bears are definitely in the ascendant...

Appendix: The world's three largest silver producing countries.

1. Mexico

Output: Mexico is the world's largest producer of pure silver, with output far exceeding that of other countries.

Status: Mexico owns the world's largest silver company - Fresnillo, and one of the world's two largest silver mines.

2. China

Output: China's silver output ranks second among the world's top ten silver producing countries.

Characteristics: China's silver production is mostly a byproduct of other metals, such as the smelting of copper, lead, and zinc, which produces a large amount of silver.

III. Peru

Production: Peru ranks third in the world in silver production.

Reserves: Peru possesses the world's largest known silver reserves, therefore its silver mining potential is enormous.

Major Mines: Most of Peru's physical silver production comes from the Antamina mine, a prolific silver bar producer, but primarily a copper mine where silver is a byproduct.

Related Information