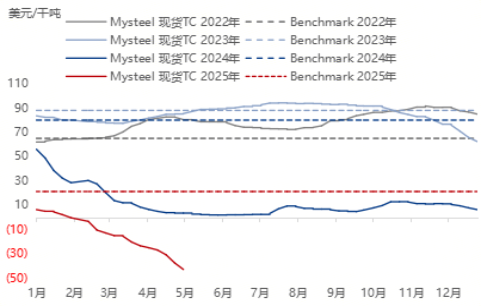

Copper concentrate TC continues to decline, with negative processing fees first reported in half-year long-term contract negotiations.

Release Time:

2025-05-28

As of May 27, 2025, the standard clean copper concentrate TC index was -$42.4 to -$44.25 per dry metric ton, with a monthly average of -$43 per dry metric ton, a month-on-month decrease of 30.3%, and a year-on-year decrease of 2054.5%.

As of May 27, 2025, the standard clean copper concentrate TC index was -$42.4 to -$44.25 per dry metric ton, with a monthly average of -$43 per dry metric ton, a month-on-month decrease of 30.3%, and a year-on-year decrease of 2054.5%. The spot price of clean copper concentrate (25%) was $2491-$2544 per dry metric ton, with an average price of $2511 per dry metric ton, a month-on-month increase of 3.3%, and a year-on-year decrease of 3.5%.

In May, the copper concentrate spot market continued the weak pattern of April, with TC remaining under pressure and a strong wait-and-see attitude in the market.

Driven by BHP's bidding and other mines, TC further fell to the range of -$40 to -$45 per dry metric ton. TC remained under pressure, and the market's wait-and-see attitude was strong. After the holiday, the transaction TC between traders and refineries was -$42, and the transaction TC between traders and northern refineries was -$43; the transaction TC between traders and refineries was -$44; in the middle of the month,Bisha mine's bidding for 10,000 tons of copper concentrate in June ended at a high of -$80, and Anglo American Resources had a two-year batch of 40,000 tons. The 2025 batch was capped at -$80, and the 2026 batch was traded at -$40. At the end of the month, BHP's bid price for July shipment to smelters was -$45, and the transaction price for June shipment with a price period of M+5 was -$41. The transaction price of mixed ore was -$37 to -$38 per dry metric ton. On May 26, Antofagasta and Chinese smelters held mid-year negotiations, proposing a first-round offer of TC -$15 per dry metric ton and RC -1.5 cents per pound. The processing fee for the 2025 signed annual agreement fell by 73.4% to $21.25 per ton compared to 2024, setting a new low. The divergence between buyers and sellers widened: traders were reluctant to sell due to bullish expectations, while smelters had low willingness to accept goods due to cost constraints, resulting in reduced spot transactions.

Smelters: TC has been in the negative range for a long time, squeezing smelters' profit margins. Some smelters said that a TC price below -$40 is unacceptable. As a by-product of smelting, the price of sulfuric acid is currently stable, but its price transmission effect on the copper concentrate market is weak.

Traders: June goods have been basically sold out, BHP's bid price has become an important reference for market transactions, and actual transactions are rare, hovering around the median of -$40.

In May 2025, the copper concentrate spot market continued to experience pressure on TC, the price center shifted downward, market transactions were sluggish, and participants had a strong wait-and-see attitude. Although spot prices rose slightly, the decline in TC offset some of the gains, increasing the cost pressure on smelters. The TC price may fluctuate in the low -$40 range, and the results of BHP's bidding and the progress of Antofagasta's long-term contract negotiations will be key influencing factors. After the first round of bidding for the six-month long-term contract negotiations,

Copper Concentrate Prices 2022-2025

Domestic Mines:

As of May 27, 2025, the pricing coefficient for 20% grade copper concentrate was 94.1%, a year-on-year increase of 1.13 percentage points, and the average spot price was 14532 yuan/dry metric ton, a month-on-month decrease of 1.39%; the pricing coefficient for 23% grade copper concentrate was 96.6%, a year-on-year increase of 1.13 percentage points, and the average spot price was 17156 yuan/dry metric ton, a month-on-month decrease of 1.39%.

The activity of the domestic mine spot market was relatively stable. Domestic mines mainly executed long-term contracts, and the frequency of spot purchases was not high. The pricing coefficient remained high for many weeks. Under the background of tight raw material supply, smelters' rigid demand for domestic mines, although the frequency of spot purchases was low, the stable execution of long-term contracts supported market activity. Smelters' purchasing sentiment was cautious, but some miners said they planned to increase spot trading in the later period, which may indicate that market liquidity will gradually improve.

The tight supply situation of imported copper concentrate has not eased, and domestic mines have become an important supplementary source for smelters. Market participants said that the pricing coefficient quotation range for domestic mines in the spot market was large and chaotic, and some high-quality mines had higher bidding coefficients.

The continued low level of imported mine processing fees (TC/RC) has prompted smelters to increase the proportion of domestic mine purchases. Recently, the amount of imported to domestic scattered goods has increased, but the overall supply remains tight, and some market participants plan to raise the spot pricing coefficient.

Smelters' purchasing sentiment is cautious, mainly executing long-term contracts, but some miners expect that future spot trading will increase, which may be related to raw material inventory levels and production plan adjustments.

The environmental impact report for the 900,000-ton expansion project of Yifeng Xinzhuang Copper, Lead and Zinc Mine of Jiangxi Yifeng Wanguo Mining Co., Ltd. is subject to public announcement. The mine construction target is 1 million tons/year, and the current mining and selection scale has reached 600,000 tons/year. This expansion to 900,000 tons/year may increase long-term supply potential.

It is expected that the pricing coefficient will remain stable at a high level in the short term, supported by tight supply and low processing fees for imported mines. Some market participants plan to raise the spot pricing coefficient, which may lead to a gradual convergence of the quotation range. If the tight global copper concentrate supply situation does not improve, the pricing coefficient of domestic mines may remain high for a long time.

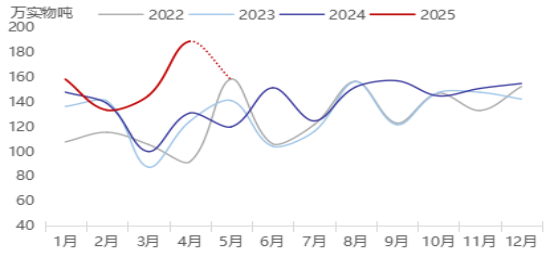

Supply:

Global copper concentrate shipments in April 2025 were 3.757 million tons, a month-on-month decrease of 18% and a year-on-year decrease of 5%. Compared with the previous month, shipments decreased significantly, with the most significant decrease in Chile. Compared with the same period last year, except for a decrease in shipments from Chile, shipments from most other countries increased, with the most significant increases in Turkey and Canada.

In April 2025, Chile's copper concentrate shipments were 1.048 million tons, a month-on-month decrease of 28% and a year-on-year decrease of 26%. Compared with the previous month, shipments decreased significantly. Except for the increase in shipments from Mejillones and Caleta Coloso ports, shipments from other ports decreased. Caleta Coloso and Mejillones increased by 17,000 tons and 63,000 tons respectively, while Puerto Patache decreased most significantly, with a decrease of 163,000 tons, followed by an 85,000-ton decrease in Caldera port. Compared with the same period last year, shipments from multiple ports decreased, mainly due to significant decreases in shipments from Quintero, Puerto Patache, Caleta Coloso, and Michilla ports, with decreases of 125,000 tons, 84,000 tons, 51,000 tons, and 37,000 tons respectively, while Mejillones increased significantly, with an increase of 126,000 tons.

From January to April 2025, Chile's cumulative copper concentrate shipments were 5.123 million tons, a year-on-year increase of 14.6%. Compared with the same period last year, except for a decrease in cumulative shipments from Antofagasta and Puerto Patache ports, cumulative shipments from other ports increased. Antofagasta port's cumulative shipments decreased by 82,000 tons year-on-year. The most significant increase was in Mejillones port, with a year-on-year increase of 289,000 tons.

In March 2025, Peru's copper concentrate shipments totaled 987,000 tons, down 11% month-on-month and up 4% year-on-year. Shipments from Callao port increased by 118,000 tons month-on-month and 203,000 tons year-on-year; Punta Lobitos port shipments decreased by 179,000 tons month-on-month and increased by 120,000 tons year-on-year; Ilo port shipments decreased by 93,000 tons month-on-month and increased by 64,000 tons year-on-year; Matarani port shipments increased by 32,000 tons month-on-month and decreased by 305,000 tons year-on-year.

From January to April 2025, Peru's cumulative copper concentrate shipments reached 4.203 million tons, an increase of 11.3% year-on-year. Compared to the same period last year, all ports except Matarani showed an increase in cumulative shipments. Matarani port's cumulative shipments decreased by 1.278 million tons year-on-year. The most significant growth was seen in Punta Lobitos port, with a year-on-year increase of 984,000 tons, while Callao and Ilo ports saw increases of 388,000 tons and 331,000 tons respectively.

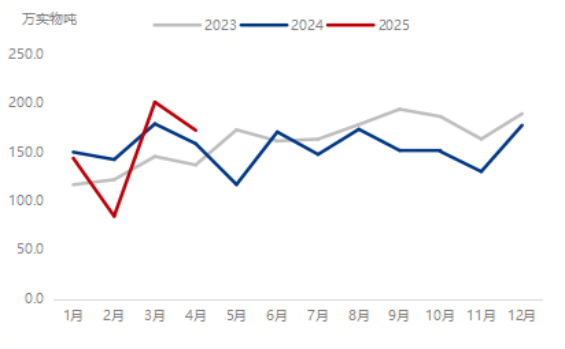

Global Copper Concentrate Shipments

Statistics show that in April 2025, the actual arrival of copper concentrate at 17 Chinese ports was 2.726 million tons, a 21.3% increase month-on-month and a 27.7% increase year-on-year. This month's actual arrival volume significantly exceeded the original plan, particularly in Fangchenggang, which exceeded the plan by 250,000 tons, followed by Zhangjiagang with an increase of 100,000 tons, while Tianjin port decreased by 40,000 tons compared to the original plan. Compared to the previous month, many ports showed a significant increase in actual arrivals, most notably Fangchenggang, Zhangjiagang, and Nanjing ports.

(Original data: In April 2025, the actual arrival of copper concentrate at 14 Chinese ports was 2.196 million tons, a 23.0% increase month-on-month and a 29.0% increase year-on-year. In April 2025, the actual arrival of copper concentrate at 7 Chinese ports was 1.89 million tons, a 30.3% decrease month-on-month and a 44.2% decrease year-on-year.)

Statistics show that the estimated arrival of copper concentrate at 17 Chinese ports in May 2025 is 2.3 million tons, a 15.6% decrease month-on-month and a 14.9% increase year-on-year. The estimated arrival volume at many ports in May decreased compared to April, with significant decreases observed at major ports such as Fangchenggang, Zhangjiagang, and Nanjing. (Original data: The estimated arrival of copper concentrate at 14 Chinese ports in May 2025 is 1.86 million tons, a 15.3% decrease month-on-month and a 16.1% increase year-on-year. The estimated arrival of copper concentrate at 7 Chinese ports in May 2025 is 1.58 million tons, a 16.4% decrease month-on-month and a 31.7% increase year-on-year.)

Copper Concentrate Arrivals at 7 Chinese Ports

Demand:

In April 2025, China's mine-produced copper output was 745,000 tons, up 0.72% month-on-month and 16.97% year-on-year. The difference between China's refined copper and mine-produced copper output in April was 364,000 tons, down 6.6% month-on-month and up 13.1% year-on-year. From January to April 2025, China's mine-produced copper totaled 3.067 million tons, up 7.7% year-on-year; the difference between China's refined copper and mine-produced copper output was 1.271 million tons, up 21.1% year-on-year. Five domestic smelters underwent maintenance in April; otherwise, smelters mostly operated as planned. Although TC has fallen to a low point, smelters generally purchase according to plan. A domestic smelter stated: "Even at the current price, we have to buy goods, with a certain amount of long-term orders guaranteed, and the favorable byproduct market can compensate for the negative processing fee." Although some small smelters have increased the input of miscellaneous materials and cold materials, the overall impact on output is limited.

China's estimated mine-produced copper output in May 2025 is 761,000 tons, up 2.1% month-on-month and 14.2% year-on-year. From January to May 2025, China's estimated mine-produced copper output is 3.828 million tons, up 8.9% year-on-year; the difference between China's refined copper and mine-produced copper output is 1.636 million tons, up 19.8% year-on-year. Three companies are expected to undergo maintenance in May, and companies that underwent maintenance earlier are mostly planning to resume production. On the other hand, the increase in copper concentrate imports provides raw material support for smelter production, and output is expected to increase in May.

Related Information